e-Invoicing system will begin with businesses that have RM100mil turnover in August 2024, followed by businesses that have RM50mil turnover and RM25mil turnover before applying to individuals.

Chief Executive Officer of IRB, Mohd Nisom Sairi

Electronic invoicing (e-invoicing) is becoming a part of business operations in Malaysia to make invoice handling more efficient through digitization.

IRB is setting up a platform for the submission and validation of all e-invoices that meet Malaysia's requirements.

This not only keeps the cost of e-invoicing implementation low but also supports local software providers and encourages businesses to use e-invoicing.

For now, businesses with an annual turnover of over RM 100 million will need to adopt e-invoicing by June 2024.

Table of Content

- What Is e-Invoicing in Malaysia?

- 3 Purpose of Implementing e-Invoicing System in Malaysia?

- How Does e-Invoicing Benefit Malaysian Businesses?

- 2 e-Invoice Transmission Mechanisms

- What Is The Process of e-Invoicing In Malaysia?

- When You Should Start Implementing e-Invoicing?

- Best ERP Software for e-Invoicing in Malaysia

You can always access to e-Invoice portal and e-Invoice Guideline to check out the latest announcement.

What Is e-Invoicing In Malaysia?

What Is e-Invoicing In Malaysia?

e-Invoice is a digital representation of a transaction between a seller and a buyer, applying to all taxpayers engaged in commercial activities in Malaysia.

As per Datuk Koong Lin Long, the treasurer-general of ACCCIM, e-invoicing is essentially a transition in the way businesses generate invoices, similar to the shift from using cash to adopting e-wallets.

e-Invoicing mainly covers 3 transaction types which are B2B, B2C and B2G.

Similar to traditional invoice, e-invoice must contain 53 mandatory fields, including important details such as seller & buyer details, item description, quantity, price, tax, payment details, and more.

The only difference between e-invoice and traditional invoice lies in the format.

While a traditional invoice is typically presented on paper or electronically in formats like PDF, Excel or Word, e-invoice is created in XML or JSON format, allowing for automated processing by systems.

3 Purpose of Implementing e-Invoicing System in Malaysia?

The implementation of the e-invoicing system reflects Malaysian government and tax authorities’ dedication to digital transformation.

Other than digital transformation, e-invoicing system serves another 3 primary purposes:

- Improving tax compliance: e-invoicing allows the government to analyze detailed information on economic transactions by businesses, addressing the grey economy.

- Promoting data transparency: e-invoices are generated in a standardized format, making data more understandable and transparent.

- Full integration with GST system: e-invoicing system integrates with GST system seamlessly, improving both accuracy and timeliness of GST reporting

How Does e-Invoicing Benefit Malaysian Businesses?

Let's also talk about how e-Invoicing benefits Malaysian businesses, going beyond what it does for the government. Here are the four benefits:

- Requires minimal manual effort as transaction documents are submitted electronically to IRBM

- Seamless system integration improves both efficiency and accuracy of tax reporting

- Automation significantly reduces time and effort to collect data for year-end financial reporting

- Digitalization reduces the need for paper usage and physical document storage

2 e-Invoice Transmission Mechanisms

Other than benefits, IRBM also urges business owners must submit all e-invoices to the platform called IRBM portal for validation and registration.

And, business owners have 2 options to choose from to submit e-invoices to IRBM portal:

- MyInvois Portal

MyInvois portal is a platform hosted by IRBM for manual e-invoice submissions, open to all taxpayers without any associated cost. - Application Programming Interface (API)

API allows automatic data transmission between taxpayers' business software and MyInvois system. This approach is ideal for businesses handling large transaction volumes.

What Is The Process of e-Invoicing In Malaysia?

What Is The Process of e-Invoicing In Malaysia?

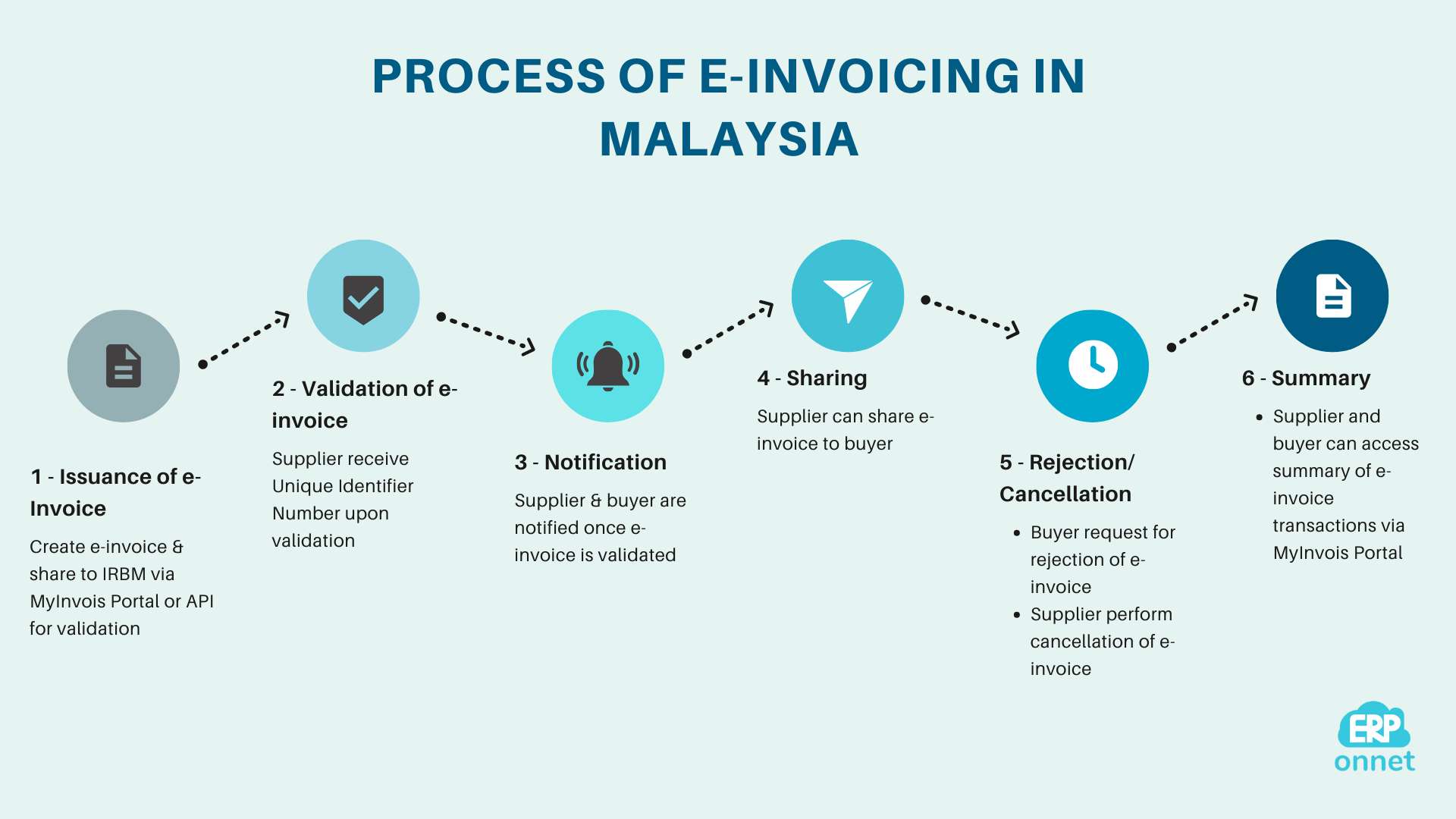

After choosing the e-invoicing transmission method you prefer, let's explore how e-invoicing works in Malaysia.

After transaction is made, supplier creates an e-invoice and submits it to IRBM

IRBM will validate e-invoice in real-time

Once validated, supplier will receive a Unique Identifier Number from IRBM that allow traceability

Both supplier and buyer will receive notification of validated e-invoice

Supplier has the responsibility to share e-invoice embedded with QR code to buyer

- Upon issuance, a specified timeframe is given for the buyer to request for rejection of e-invoice or the supplier to cancel the e-invoice

Finally, both supplier and buyer can access a summary of e-invoice transactions via MyInvois Portal

When You Should Start Implementing

e-Invoicing?

In this section, let's check when your business needs to adopt e-invoicing according to the implementation timeline prepared by IRBM.

By January 2017, e-invoicing will be mandatory for all taxpayers, regardless of your business's annual turnover threshold.

Although large enterprise kick start e-invoicing first, but in Malaysia, most businesses involved in supply chain. This means even smaller businesses might need to use e-invoicing earlier to keep things running smoothly.

Best ERP Software for e-Invoicing in Malaysia

You can choose to use MyInvois portal for manual e-invoicing, but it can be extremely slow when you have a lot of invoices to deal with because you have to input data yourself.

If you're leaning towards automated e-invoicing with ERP API integration, keep reading.

Common e-invoicing ERP systems like SAP, Oracle, and Odoo are designed to meet global standards, and adapting them to fit local Malaysian requirements can be quite challenging.

That’s why finding ERP system provider who is familiar with Malaysian business landscape is key - they get your needs and can tailor a localized solution just for you.

And here’s something to take note: Integrating your business software with the government’s PEPPOL network might raise compatibility issues. So, it’s not about having good ERP software only; ongoing support from your provider is crucial to fix issues fast.

So, remember to look for ERP system provider committed to having your back whenever you need it.